Transferring high-interest credit card balances to a 0% APR balance transfer cards can be an effective debt payoff strategy. By moving balances from cards charging 15%+ interest to one with an intro 0% rate that lasts 12-21 months, you greatly reduce interest fees so more of your payment goes to paying down principal.

This comprehensive guide covers everything you need to know about balance transfer cards, from how they work to finding the best offers. Read on to learn if a 0% balance transfer is right for your situation.

Welcome to the US balance transfer

Table of Contents

- What Are Balance Transfer Credit Cards and How Do They Work?

- Who Should Use a 0% Balance Transfer Card?

- Finding the Best Balance Transfer Credit Cards

- Step-By-Step Guide on How To Do a Balance Transfer

- Balance Transfer Credit Cards Pros and Cons

- Balance Transfer Credit Card Alternatives

- Tips for Getting the Most From Balance Transfer Cards

- The Bottom Line on Balance Transfers

- FAQs About Balance Transfer Credit Cards

What Are Balance Transfer Credit Cards and How Do They Work?

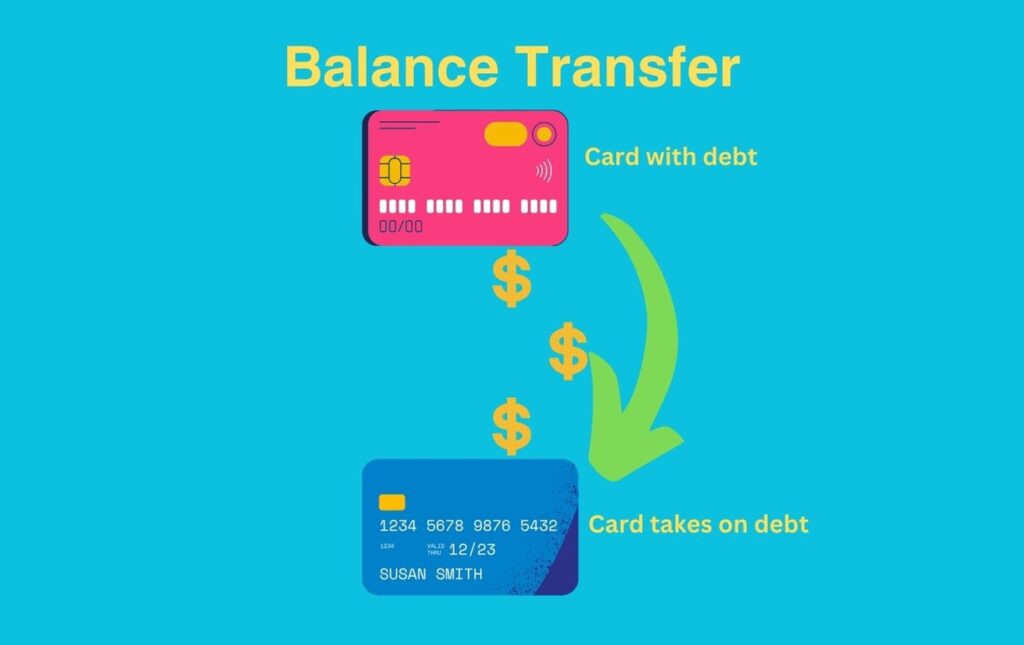

A balance transfer credit card is a special type of card that offers a 0% introductory APR on transferred balances for a set period of time, usually between 12 and 21 months.During the intro period, all payments you make go entirely toward paying off your existing balance rather than interest.

You initiate a balance transfer by requesting your credit card issuer to pay off balances from another card(s). The process takes about 1 week on average. Most card issuers charge a balance transfer fee, typically 3-5% of the amount transferred.

By not accruing interest for 12+ months, you can pay off a large chunk of credit card debt and save substantially on interest charges. This allows you to become debt-free sooner.

Who Should Use a 0% Balance Transfer Card?

If you carry high-interest credit card balances month-to-month, a 0% APR balance transfer card can help accelerate your payoff timeline. These cards work best for borrowers with good credit (scores of 690+) who can repay balances in full before rates rise.

Specifically, balance transfer cards are ideal if:

- You have high credit card balances on accounts charging 15% or more interest

- You have large purchases coming up you won’t be able to pay in full right away

- You want to save money by not paying interest for 12 months or more

- You have a monthly budget to repay your full balance within the 0% intro period

Consumers who only occasionally carry a balance or have existing debt on installment loans likely won’t benefit as much. [2] You need to have the means to make consistent monthly payments that will eliminate your entire transferred balance by the end of the intro 0% term.

Finding the Best Balance Transfer Credit Cards

The most important factor when balance transfer credit card shopping is the length of the 0% intro APR period. You want ample time to repay debt completely without interest. Here are the key things to compare:

- Intro APR length – Top cards offer 0% interest for up to 21 months on transferred balances

- Balance transfer fee – Typically ranges from 3-5% of the transferred amount

- Credit needed – Many cards require good to excellent credit (690+ score)

- Intro and standard purchase APR – Some cards also offer 0% interest on new purchases

Review the following chart showcasing some of the best long 0% balance transfer cards:

| Card | 0% Intro Term | BT Fee | Credit Needed |

| Citi Diamond Preferred | 21 months | 5% | Good |

| U.S. Bank Visa Platinum | 20 months | 3% | Good |

| Wells Fargo Reflect | 18 months | 3% | Excellent |

| BankAmericard | 18 months | 3% | Good |

As you can see, the Citi Diamond Preferred tops the list with a lengthy 21-month 0% offer on transferred balances. Just note that most balance transfer cards charge relatively high interest rates after the intro period ends.

So your goal is to completely eliminate transferred balances within the 0% term. Make sure to understand when the intro APR ends and plan payments accordingly.

Step-By-Step Guide on How To Do a Balance Transfer

Follow this process to transfer balances from high-APR credit cards onto a 0% intro balance transfer card:

- Apply and get approved for a balance transfer credit card based on factors like APR length, fee %, and your credit score.

- Complete balance transfer request forms: After approval, the issuer will include transfer forms to submit with your first bill. You list other accounts and amounts to be paid off.

- Wait 5-7 days for completion: Your credit card company electronically transfers the balance amount(s) to the other issuer(s). Expect a balance transfer fee charge. [5]

- Stop using paid off accounts: Going forward put all charges on your new balance transfer card with the 0% APR introductory period.

- Pay down principal every month during the 0% interest term until reaching a $0 balance. Avoid new purchases on this card if possible.

- Continue payments after APR ends to finish off the remaining balance using budgeted monthly installments.

The key is making a plan BEFORE doing a balance transfer to pay off 100% of balances within the intro 0% period. Know exactly how long the promotional APR lasts and divide your total balance amount by the number of months in the term to get your monthly payoff goal.

Balance Transfer Credit Cards Pros and Cons

Like any financial product, balance transfer cards have both advantages and potential drawbacks depending on your situation. Consider these pros and cons:

Benefits

- 0% APR for over a year – No interest charges for 12-21 months dependant on card

- Pay debt faster – More payments go to principal vs. interest fees

- Consolidate multiple balances – Combine onto one card with lower intro APR

- Can request multiple transfers – Transfer remaining balances to a new card

Drawbacks

- Transfer fees apply – Usually 3-5% of the balance transferred

- High standard rates – Interest spikes after intro period ends if a balance remains

- Need excellent credit – Only consumers with 690+ scores qualify for best cards

- Debt remains – Balance transfers only delay interest, don’t make debt disappear

The most significant risk involves not eliminating transferred balances by the end of the 0% term. If any balance rolls past the intro period expiration date, high interest charges resume accruing.

Have an emergency fund to cover at least a few months of minimum payments in case of lost job or other financial hardship during the balance transfer process. Only transfer amounts you know for sure you can repay in-full within the intro 0% timeframe.

Balance Transfer Credit Card Alternatives

While balance transfers allow you to save substantially on interest payments, they aren’t your only option for accelerating debt repayment:

- Debt consolidation loans – Unsecured personal loans or home equity loans with lower fixed rates can combine multiple balances into one payment/term. But qualifying requires very good credit.

- Debt management plan – Debt relief companies negotiate with your creditors to waive fees/interest and put you on affordable repayment plan. There are monthly DMP administration fees.

- Credit counseling services – Non-profit credit counseling agencies provide free education, budget help, and tailored debt repayment solutions. No upfront fees but donations welcomed.

- Debt settlement – Debt settlement companies negotiate lump-sum payoffs with creditors for less than what you owe. This has major credit score impacts and upfront settlement fees.

- Bankruptcy – Declaring Chapter 7 or Chapter 13 bankruptcy eliminates eligible debt entirely or creates court-mandated repayment plan. This destroys credit scores for years.

Evaluate all options thoroughly based on your specific debt situation. In many cases, balance transfer cards offer cheaper, faster relief than alternatives if you use them strategically and commit to payoff discipline.

Tips for Getting the Most From Balance Transfer Cards

Follow these best practice tips to ensure balance transfer plastic accelerates your debt elimination:

- Transfer highest-interest balances first then work down to lower-rate debts

- Create a monthly repayment budget that pays off 100% of transfers before 0% term ends

- Stop using old credit cards with transferred balances to avoid racking up new interest charges

- Make payments on time each month and always pay more than the minimum due

- Avoid additional purchases on balance transfer card beyond emergency needs

- Contact issuer right away if temporary financial troubles prevent making full monthly payments

- Line up another balance transfer card to move any remaining balances if intro APR will soon expire

The key is going “all in” on repayment during the 0% intro period so ALL transferred debt if eliminated by the time interest kicks back in on your balance transfer account.

The Bottom Line on Balance Transfers

When used responsibly by consumers with the means to repay balances in-full during extended 0% APR intro periods, balance transfer credit cards provide an affordable way to become debt-free faster. Make sure to calculate your payoff budget accurately, stick to monthly payment discipline, and have a contingency plan if your financial situation unexpectedly shifts.

Carefully compare balance transfer offers from various card issuers to find one that aligns with your credit profile and payoff timeline needs. Prioritize cards with longer 0% terms, lower transfer fees, and solid customer service reputations.

By consolidating multiple high-interest credit card balances onto a single card charging 0% temporary introductory interest, you save substantially on finance charges. This allows you to direct the maximum possible monthly payments toward eliminating principle debt for good.

Just commit to a reasonable payment plan that pays off your entire transferred balance BEFORE the card’s normal interest rate kicks back in. And refrain from using the card for additional purchases until all transferred balances are gone to avoid new interest fees that undermine the entire purpose of doing a 0% balance transfer.

FAQs About Balance Transfer Credit Cards

Have more questions? Here are answers to our most frequently asked balance transfer questions:

How many balance transfers can I do?

Most balance transfer cards let you submit multiple transfer requests to consolidate debt from various accounts. Some may cap the total maximum transfer limits.

When should I apply for a balance transfer card?

Apply for a balance transfer card as soon as you realize you’ll be carrying ongoing credit card debt month-to-month. Don’t wait right until an existing 0% intro APR nears expiration.

Can I transfer balances between two cards from the same bank?

Yes, you can transfer balances from one bank’s credit card to a different card product from the same issuer. Many banks offer balance transfer card deals to existing customers.

Is there a way to avoid balance transfer fees?

A few credit unions and small banks offer fee-free balance transfer deals. But major nationally available card brands like Visa, Mastercard, Discover, and American Express typically charge 3-5% balance transfer fees.

What credit score is needed?

To qualify for the best and longest 0% balance transfer cards, you typically need good to excellent credit – FICO scores of 690+ or higher. If your score is lower, consider alternative debt relief options.

Can I transfer small business credit card balances?

No, small business credit cards are treated separately from consumer cards. Balance transfers can only occur between personal cards. Business owners need a separate small business debt relief strategy.

6 thoughts on “0% APR Balance Transfer Card : Mastering your Debt easily”