Balance transfer cards have become an extremely popular tool for managing credit card debt over the past few years. As interest rates continue rising in 2024, these cards will likely become even more useful for consumers looking to reduce interest charges.

This article provides an in-depth look at what balance transfer cards are, their benefits and drawbacks, the best cards available, and tips for using them effectively.

What is a Balance Transfer Card?

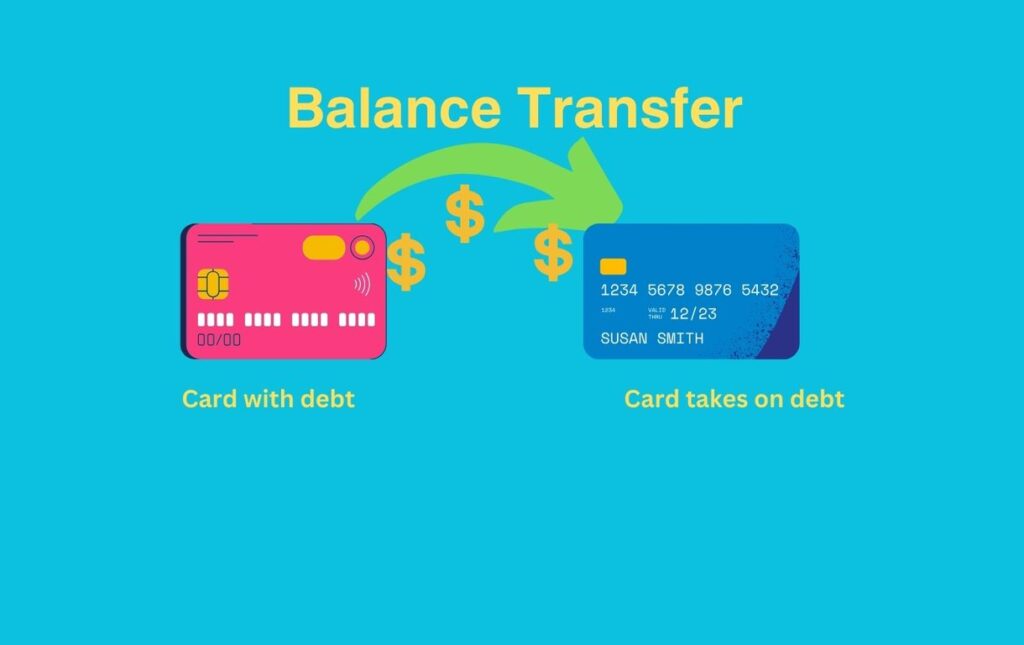

A balance transfer credit card allows you to transfer outstanding balances from other credit cards over to the new card. The key benefit balance transfer cards provide is an introductory 0% APR period, usually lasting between 12 and 21 months. During this intro period, all new purchases and transferred balances accrue no interest. This gives you breathing room to pay down debts faster.

Balance transfer cards work by providing checks or electronic transfer forms. You use these to pay off balances on other cards. The payment then posts to your balance transfer card, not the original account. This keeps the accounts open while moving the debt.

Why Use a Balance Transfer Card in 2024

2024 is shaping up to be a very expensive year for credit card borrowers. The Federal Reserve raised interest rates several times in 2023 to combat inflation. Most credit card Annual Percentage Rates directly correlate to the prime rate. So as the Fed raises rates, variable APRs on credit cards move higher in tandem.

Current projections expect the prime rate could exceed 7% by the end of 2024. That would push typical credit card interest rates over the 20% mark for consumers with good credit. Carrying credit card debt at 20%+ interest can quickly become financially devastating.

Fortunately, 2024 also brings a fresh set of fantastic balance transfer offers. Moving existing balances over to these new introductory 0% APR cards allows you to save tremendously on interest. For example, you could transfer a $5,000 balance and completely pay it off within 15 months while accruing $0 in interest charges.

The Downsides of Balance Transfer Cards

While opening a new balance transfer card can provide excellent savings, these products do come with some downsides to consider as well. Some of the most common drawbacks include:

- Balance transfer fees – Most cards charge a 3-5% fee to transfer over a balance initially. This reduces your overall savings. However, you still typically come out well ahead over paying ongoing high interest rates.

- Reverting to high variable APRs – When the intro 0% APR period ends, unpaid balances start accruing interest at a card’s regular variable rate. Current standard rates on most cards exceed 17% .

- Limited-time offers – New balance transfer deals come and go constantly. If you miss the short application window to grab a great offer, you might need to choose a card with less favorable terms.

- Balance transfer limits – Issuers typically set a cap of around 50% of a card’s total credit limit allowed for balance transfers. In some cases, this amount is too low to consolidate all your balances with one card.

- Temporary accounts age reduction – Opening a new credit card temporarily lowers your average account age, even when keeping older cards open. This can moderately ding your credit scores for 6-12 months after getting approved for a new card.

Even with the downsides, the interest savings usually far outweighs any negatives though. As long as you have a solid payoff strategy for your debts in place, balance transfer cards offer excellent financial value overall.

The Best Balance Transfer Credit Cards for 2024

The credit card industry remains highly competitive heading into 2024, with issuers vying for new borrowers. Here are some of the overall best balance transfer card options available this year:

Citi Diamond Preferred Card

The Citi Diamond card provides an extraordinarily long 21 month intro 0% APR period on purchases and balance transfers (then 13.99% – 23.99% variable APR). The fee for balance transfers is only 3% (minimum $5), among the most competitive rates available. It also comes with no annual fee. Cardholders earn 2 ThankYou® Points per $1 spent on all purchases too. Overall, the Citi Diamond Preferred® Card provides exceptional flexibility for both balance transfers and ongoing rewards on spending.

Chase Slate Edge

The new Chase Slate Edge card debuting in early 2024 brings some unique advantages for balance transfers. It offers 15 months 0% intro APR with no balance transfer fees. Most competing cards still charge a 3-5% fee for transfers. After the intro APR period, the standard variable rate of 16.49% – 27.49% applies. The Slate Edge® also provides new account security protections like $0 fraud liability and complimentary credit alerts.

BankAmericard

Bank of America’s BankAmericard credit card continues to be hugely popular heading into 2024 thanks to its balance transfer offer. New cardholders get 18 billing cycles with a 0% intro APR for eligible balance transfers (then 14.74% – 26.74% variable). Transfers incur a 3% fee ($10 minimum). Plus, the BankAmericard® has no annual fee and rewards users with 1.5X points for everyday purchases.

Tips for Using a 0% APR Balance Transfer Card Wisely

The most prudent strategy includes taking full advantage of the valuable 0% intro period that balance transfer cards provide. Here are some smart ways to maximize the savings from your new card:

- Pay down highest interest debts first – Prioritizing balances with the highest APRs saves more over paying minimums. List out all debts by interest rate and systematically eliminate them from highest to lowest.

- Avoid running up card balances again – Stick to a reasonable budget each month during the intro period to keep new charges minimal.

- Pay more than the minimum due – Budget enough to pay above the minimum payment so you knock out debt principal faster. Shooting to pay 2-3X the minimum makes a huge difference.

- Line up your next balance transfer card early – About 3 months before your intro APR expires, find your next balance transfer card so you can shift remaining debts to another 0% card. Chaining balance transfer cards together keeps savings going.

- Consider debt consolidation loan options too – If you have excellent credit, a personal loan with a lower fixed rate provides another solid approach to repay debt on affordable terms over a few years.

Related Articles :

Balance transfer checks allow you to shift credit card balances to a new 0% intro APR card, saving substantially on interest. Read this guide to maximize value and accelerate debt payoff through smart consolidation

Continue Reading 0% APR Balance Transfer Checks: Crush Credit Card Debt Faster

Use 0% APR balance transfers to lower interest costs and accelerate mortgage debts. Cut credit card rates to free up cash flow for extra principal payments. Managing mortgage loans can be challenging, especially when other debts like credit card balances…

Continue Reading How to Manage Your Mortgage Debt Using Balance Transfers?

Closing Thoughts

The rising variable APR environment makes 2024 a very expensive year to carry long-term credit card balances. With interest rates exceeding 20% on many cards, debt payoff feels almost impossible.

Luckily, by grabbing one of the fantastic balance transfer card deals arriving in 2024, you can eliminate interest costs for 12 months or more. Take time to create a realistic payoff plan as you transfer your balances over to a temporary 0% intro APR account. Maintain diligent monthly payments above the minimum while rates sit at 0% to knock down your debt principal fast. This simple but proven balance transfer strategy gives you the breathing room needed to finally eliminate high-interest credit card debt for good in the new year.

When you transfer balance on credit cards what happens ?

When you transfer a balance from one card to another, the balance on the old card goes to $0 unless you have pending charges. The debt is moved to the new card with typically a lower interest rate .

Can I keep transferring credit card balances?

Yes, you can keep transferring credit card balances to new cards as long as you qualify. This allows you to continue benefiting from low intro APRs.

Can i transfer my credit card balance to a personal loan?

Yes, you can transfer your credit card balance to a personal loan. The loan proceeds can then be used to pay off the credit card debt.

How many times can you balance transfer from the same card ?

There is typically no limit on the number of times you can balance transfer from the same card, as long as you qualify each time.

Is there a limit on balance transfers?

Most cards do not have a limit on the amount you can transfer, but it cannot exceed the credit limit on the new card.

What happens if I balance transfer more than I owe?

If you transfer more than you owe, the excess funds may be sent to you as a check or deposited in your bank account.

How are payments applied to multiple balance transfers?

When making payments on a card with multiple balance transfers, payments typically apply to transfers with the lowest interest rate first.

3 thoughts on “Why You Need Balance Transfer Cards Them To Pay Off Debt Fast In 2024”