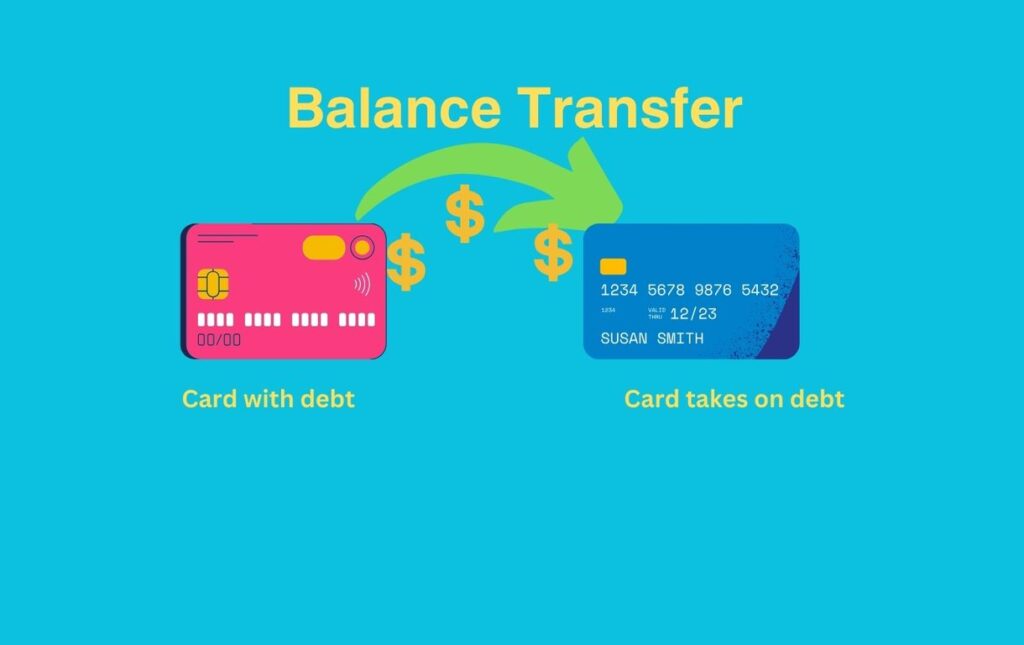

Follow this comprehensive 10-step guide to smoothly transfer high-interest credit card balances to a 0% APR card and save substantially on interest charges.

Transferring high-interest credit card balances to a new card with a promotional 0% APR period can save you hundreds or even thousands of dollars in interest charges. But balance transfers need to be executed carefully to avoid costly mistakes. Follow these 10 steps to smoothly transfer balances and pay down debt interest-free.

Why You Need Balance Transfer Cards Them To Pay Off Debt Fast In 2024

10-step balance transfer guide to Flawlessly Transfer Credit Card Balances:

1. Review Existing Balances and Interest Rates

The first step is taking stock of your current credit card balances and their interest rates. Log into each card account online and note down the following information:

- Account name

- Current balance

- Interest rate

- Minimum monthly payment

Tracking this data will allow you to identify the best debts to focus on for transferring to a lower-rate card. Prioritize high-interest balances first.

2. Calculate Potential Interest Savings

Once you have your balance and rate information assembled, you can calculate estimated interest costs over time. Use an online calculator to compare ongoing interest charges against moving the balance to a card with a 0% intro APR.

For example, for a $5,000 balance at 19.99% APR, you would accrue nearly $1,000 in interest over 12 months. Transferring to a 0% card would cut your interest costs to $0 during the intro period. Determining your potential savings will illustrate if a balance transfer makes financial sense.

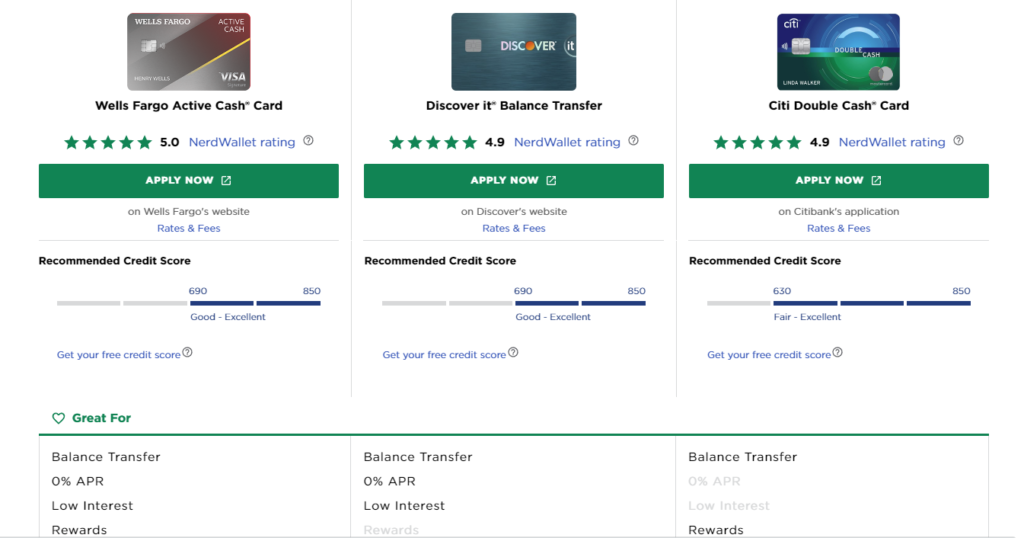

3. Research Balance Transfer Card Options

Next, investigate new credit cards offering 0% intro APR terms for balance transfers. Comparison sites like CreditCards.com and BankRate can help you find suitable offers.

Key factors to evaluate include:

- 0% intro APR duration

- Balance transfer fee

- Credit requirements

- Ongoing purchase/balance APR

A card with a long 0% term (12-18 months) and low balance transfer fee (3%) is ideal. Also confirm your credit score meets the approval criteria.

Top Balance Transfer Card Issuers of 2024

0% APR Balance Transfer Card : Mastering your Debt easily

4. Compare Balance Transfer Credit Card Offers

Put together a shortlist of top contenders for balance transfer cards based on your credit score, existing balances, and interest savings goals. Contrast the terms and perks across these options to select the best fit.

Key items for side-by-side comparisons:

- 0% APR duration

- Balance transfer fees

- Credit limit

- Rewards benefits

- Foreign transaction fee

Aim for at least 12 months of 0% financing and a credit line exceeding your transfer amount.

5. Plan For Payoff During the Intro Period

After completing a balance transfer, the critical piece is making a plan to eliminate the debt before high interest kicks in again. Consider these strategies:

Minimum Payment Plus Extra – Make the minimum payment each month, plus an extra $100 or more towards the principal.

Pay a Fixed Amount – For example, pay $400 monthly regardless of the minimum due.

Debt Avalanche/Snowball – Order debts from high to low rate, paying minimums on all but the most expensive.

Crunch the numbers to arrive at a monthly goal that will knockout your balance transfer amount before the intro period ends.

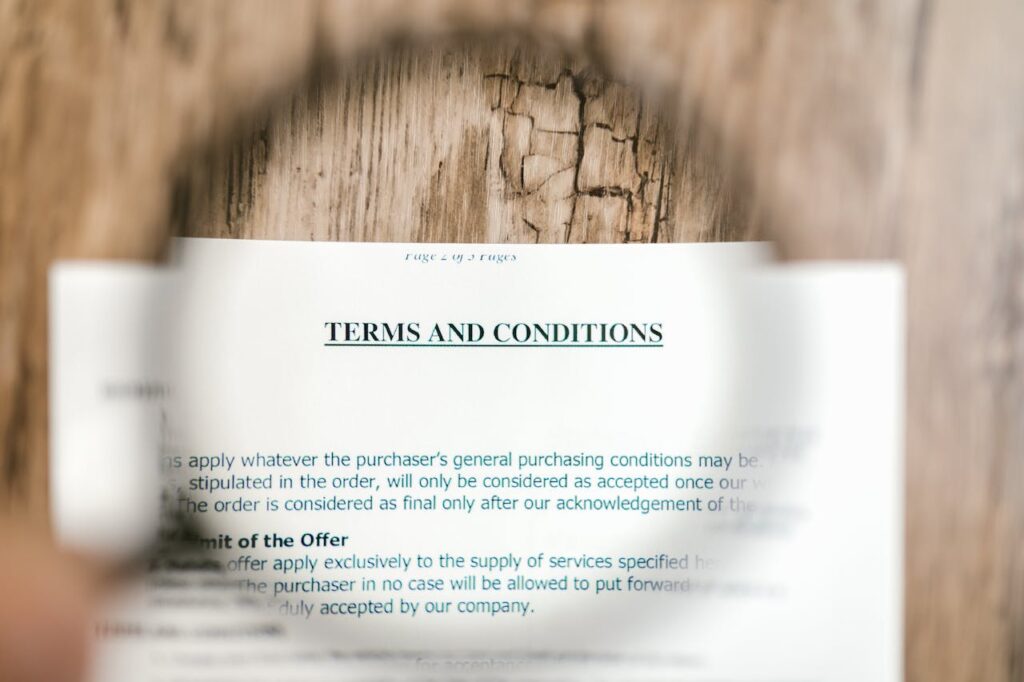

6. Mind the Balance Transfer Details

As you prepare paperwork for a balance transfer, keep an eye on crucial fine print such as:

Transaction Date – The intro 0% APR often applies from this date, not your application date.

Payment Due Dates – Avoid late fees by noting different bill cycles.

Expired Checks – Balance transfer checks may expire in 90 days. Act promptly.

Deferred Interest – If unpaid after the 0% term, all interest can get charged retroactively.

7. Submit Your Balance Transfer Application

Once you select the best balance transfer credit card for your needs, formally submit your application. Many issuers allow you to request the balance transfer during the application process. Provide key details like:

- Account numbers

- Payment mailing addresses

- Balance transfer amounts

- Recipient bank information

Double-check account details to avoid sending payments to the wrong place.

8. Confirm Your Balance Transfer Details

After getting approved for your new credit card, follow up to validate when your balance transfers will take place. Log into your new card account online or call customer service to verify:

- Balance transfer amounts matched the requested

- Funds sent to the correct payment addresses

- Intro 0% APR start date as expected

Address any discrepancies immediately to prevent issues.

9. Track Balance Transfer Progress & Make Payments

Over the next billing cycles, routinely log into your old and new credit card accounts to monitor your transferred balances. Key activities:

- Confirm transferred balances appear as credits on old cards and new charges on the new card.

- Check amounts match your initial transfer request.

- Review new card statements to validate 0% APR and make payments.

- Notify card issuers of any missing or incorrect transfers.

Stay on top of payments to avoid deferment warnings for the 0% term.

10. Pay Down Balances Before the Intro Term Ends

Keep fixed on meeting your payoff timeframe for the 0% APR duration on your new balance transfer card. As the deadline approaches:

- Recalculate payments needed monthly to eliminate debt in time.

- Be prepared to request another balance transfer if needed.

- Contact issuer about promotional financing extensions if offered.

Ideally, you will pay your transferred balance in full through on-time fixed payments before regular interest hits.

Key Takeaways

The most common pitfalls with botched balance transfers include missed payment deadlines, expired promotional financing terms, and deferred interest surprises.

By carefully evaluating top card offers, planning payback schedules, and closely tracking statement details, you can execute a seamless balance transfer to save substantially on interest. Monitor progress weekly and make payments on time for a successful balance transfer experience.

What are some common mistakes people make when doing a balance transfer?

Some common mistakes include not having a payoff plan for the 0% APR period, missing payment due dates on the new or old card, not accounting for deferred interest policies, and not tracking the progress of the balance transfer . It’s crucial to understand all the details before initiating the transfer.

How long does a balance transfer take to complete?

A balance transfer can take up to 2 billing cycles to fully process. The transferred balance will appear on your new card typically within 1 statement cycle. But allow up to 2 full cycles for the credit to show on your old card.

Can you do multiple balance transfers at once?

Yes, you can perform balance transfers from multiple credit cards onto a new balance transfer card. The total amount is subject to your credit limit. Evaluate all card terms carefully if transferring more than one balance.

Does transferring a balance impact your credit?

Balance transfers may result in a small temporary credit score drop from the hard inquiry and a lower average account age. But responsible use boosts your credit mix. The overall impact is usually minor.

1 thought on “10 Steps Balance Transfer Guide to Flawlessly Transfer Credit Card Balances”