Learn how balance transfer credit cards provide a powerful tool to minimize interest payments and maximize savings on credit card debt. Credit card debt can be an overwhelming financial burden. The high interest rates on most credit cards mean that debt can quickly snowball out of control.

What is a Balance Transfer?

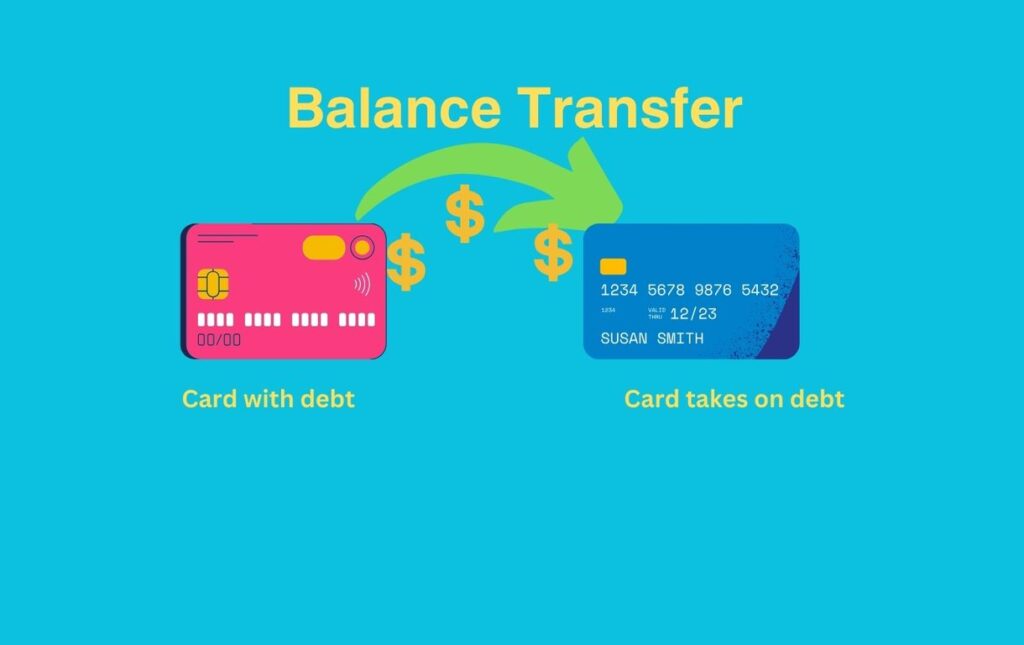

A balance transfer allows you to move an outstanding balance from one credit card over to another card. Many balance transfer cards offer an introductory 0% APR period, typically lasting between 12 and 21 months. By transferring your balance to one of these cards, you can save significantly on interest payments during the intro period.

Balance transfers are a strategic financial move to reduce credit card interest rates. They allow you to minimize debt, improve your credit score, and maximize savings.

How Do Balance Transfers Save Money?

High-interest credit card debt can trap you in an endless cycle of minimum payments and ballooning balances. Balance transfer cards disrupt this vicious cycle in two key ways:

1. Intro 0% APR Period

The most direct savings come from the temporary 0% intro APR. By transferring your balance to a card with a 0% rate, you can avoid interest fees completely during the intro period, which typically lasts 12-21 months.

2. Lower Long-Term Interest Rate

Even after the intro period ends, a balance transfer card often still has a lower ongoing purchase and balance APR than your current card. This allows you to continue saving on interest versus keeping the balance on your old card.

Maximize Savings with These Balance Transfer Tips

Follow these essential tips to ensure you maximize savings from a balance transfer:

1. Pay Off the Full Balance Within the Intro Period

The #1 rule is to pay off your entire transferred balance by the end of the card’s 0% intro period. This allows you to avoid all interest fees. Set up automatic payments or make manual payments each month to chip away at the full amount.

2. Watch Out for Balance Transfer Fees

Many cards charge an upfront balance transfer fee, usually 3-5% of the transferred amount. Factor this into your calculations — is the fee less than the interest you’d otherwise pay?

3. Don’t Use the Card for New Purchases

Only transfer an existing balance — don’t charge new purchases to the card. New spending would forfeit the interest grace period and accrue finance charges right away.

4. Review Your Options Thoroughly

Compare balance transfer offers across multiple cards to find the best terms. Key factors are the length of 0% intro APR, ongoing purchase/balance APR after intro period, and balance transfer fee amount.

5. Pay More Than the Minimum

Always pay more than the minimum payment if possible while also keeping up with payments on any other credit card debt. This pays down principal faster.

6. Plan Your Payoff Strategy

Map out a month-by-month plan to pay off the full balance transfer amount before the intro 0% APR expires so no retroactive interest gets charged.

7. Improve Your Credit Along the Way

Making consistent on-time payments shows good payment behavior and helps increase your credit score over time. This saves money in the long run via better loan/card terms.

8. Consider Refinancing Options Too

In tandem with balance transfers, explore refinancing high-interest loans like personal loans or auto loans to lower rates. Every bit of interest savings helps pay down balances faster.

Frequently Asked Questions

How much can I transfer to a balance transfer card?

Most balance transfer cards allow transfers of at least $1,000 up to your total credit limit. Some cards allow transfers exceeding your limit. The higher your credit score, the higher your limit will likely be.

When is the best time to do a balance transfer?

The sooner the better! The longer your balance sits accruing high interest payments, the more money gets wasted. Start the transfer process right away to maximize savings on interest fees over time.

Can I transfer balances from multiple credit cards to one card?

Yes, many balance transfer cards allow you to consolidate debt from multiple sources onto one card with an intro 0% APR as a strategic move to save money and simplify payments.

What credit score do I need to qualify for a balance transfer?

You’ll typically need fair to good credit — a FICO score of 690+ — to qualify for a balance transfer card with decent terms, but requirements vary by card. Those with bad credit still have options too though.

Can I transfer business credit card balances?

Sorry, balance transfers only work with personal credit card balances and loans. Business debt must stay in separate business accounts and loans.

Closing Thoughts

When used responsibly, credit cards can provide invaluable benefits in our daily lives. However, carrying a running balance with accruing high-interest charges puts you at a severe disadvantage. With some strategic planning, balance transfer cards offer a powerful solution to minimize expensive interest fees and accelerate your payoff timeline. Monitor your spending diligently, make payments on time and in full each month, and leverage balance transfers wisely as needed to amplification savings.

Back to Home

4 thoughts on “8 Savings Tips to Maximize with Balance Transfer Card Use in 2024”