A balance transfer moves debt from a high-interest credit card over to a card with a lengthy 0% intro APR. This saves substantially on finance charges. On average, balance transfer fees range from 3-5% of the amount transferred.

Compare balance transfer offers from major banks and lenders. We analyze the top issuers of 0% Balance Transfer Card Issuers of 2024.

What Should You Look For in a Balance Transfer Card Issuer?

The best balance transfer credit card Issuer provide:

- High maximum transfer limits to consolidate substantial sums

- Lengthy 0% intro APR periods (ideally over 12 months)

- Low balance transfer percentage fees (3% is best)

- Strong customer service and online account access

- Clear terms around when 0% rate expires to avoid back-interest

Review balance transfer options from both your existing bank as well as competing issuers. Compare fees, rates, credit requirements, and additional cardholder perks. [2]

Pay close attention to the length of 0% intro APR periods. You need ample time to repay transferred balances interest-free. Some student cards even offer 0% periods exceeding 2 years.

Below we analyze the top 7 bank issuers of balance transfer credit cards and highlight their best offers.

Citi Card Balance Transfers

Citi cards consistently offer some of the longest 0% intro periods for new applicants seeking to do a balance transfer, often over 18+ months. Their combination of lengthy intro APRs, broad credit access, robust web/app tools, and bonus categories make Citi a top pick. [4]

A few top Citi balance transfer cards include:

- Citi Diamond Preferred – 21 months 0%, $0 annual fee

- Citi Double Cash – 18 months 0%, 1% cash back earned

- Citi Custom Cash Card – 18 months 0%, 5% cash back category

Citi also frequently promotes enhanced limited-time balance transfer offers, so check their site for the latest deals. Expect 3% transfer fees and required credit scores in the 690+ range.

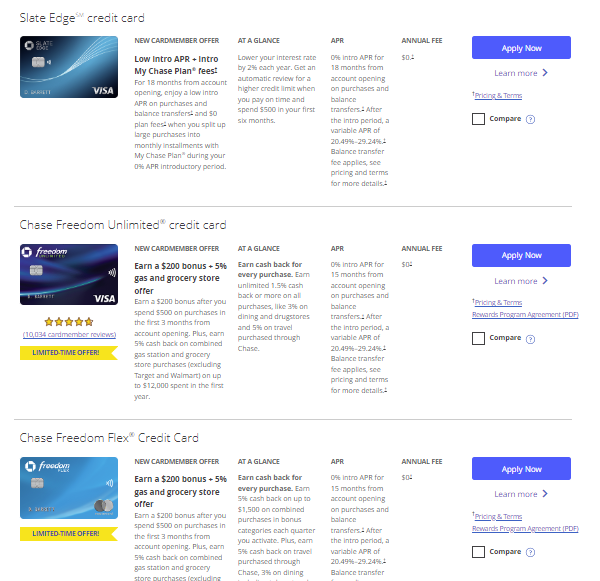

Chase Balance Transfer Credit Cards

Chase issues several excellent Visa and Mastercard options for consumers looking to shift balances from high rate cards and avoid interest for over a year. Their top cards boast intro 0% periods from 15 to 21 months.

Top Chase balance transfer card picks include:

- Chase Freedom Flex – 15 months 0%, rotating 5% cash back

- Chase Freedom Unlimited – 15 months 0%, 1.5% flat cash back

- Chase Ink Business Cash – 12 months 0%, 5% office supply rewards

Chase also offers new cardmember signup bonuses worth $150+ cash back. Balance transfer fees are usually around 5% but sometimes are discounted to 3% for a limited period. You need good credit – 720+ scores – for approval odds.

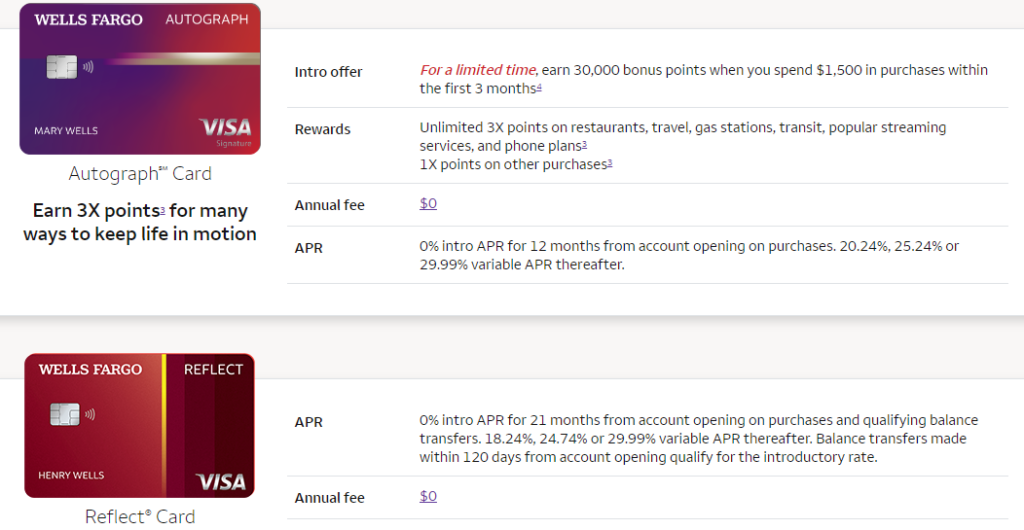

Wells Fargo Balance Transfer Cards

Wells Fargo offers two excellent balance transfer credit lines – the Reflect card and Autograph card. Both provide 12+ month 0% intro rates on transferred debt. And the Reflect charges no annual fee.

Wells Fargo’s top balance transfer picks:

- Reflect Card – 18 months 0% APR, no annual fee

- Autograph Card – 12 months 0%, up to $600 in cell phone coverage

The Reflect card is arguably the best Wells Fargo balance transfer option thanks to its lengthy intro period and lack of annual cost. Expect to pay a 3% transfer fee and have a 690+ credit score for the best approval odds.

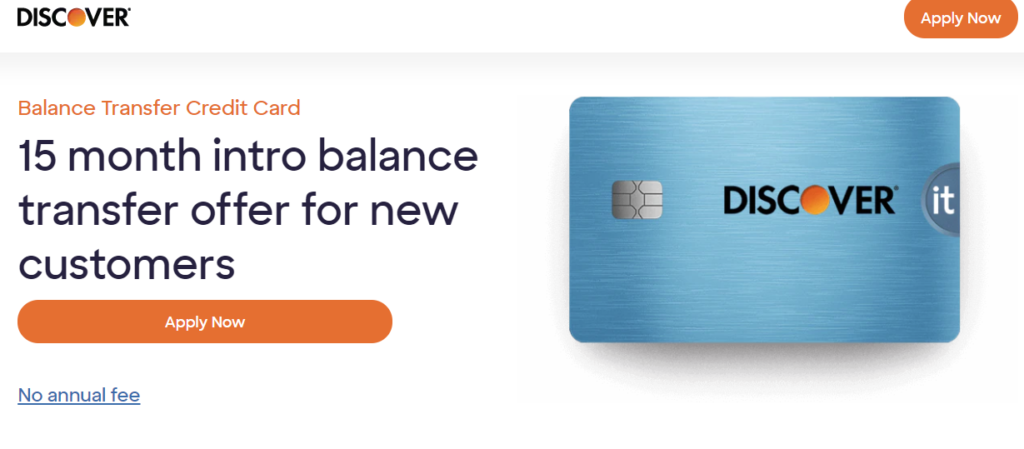

Discover Balance Transfer Card Options

Discover is unique in that it offers lengthy 0% intro rates on BOTH balance transfers and new purchases. So you can transfer old debt while also avoiding interest on fresh transactions. Discover it Balance Transfer is their primary card offering 0% intro APR periods up to 15 months.

Additional Discover perks:

- Reward cash back ranging from 1-5% back

- Enhanced cash back match after account anniversary

- Broad credit access – rewards cards open to 690+ scores

Remember Discover charges no late fees, overlimit fees, or foreign transaction fees. Plus get free TransUnion FICO scores provided monthly. Balance transfer fees are usually around 3%.

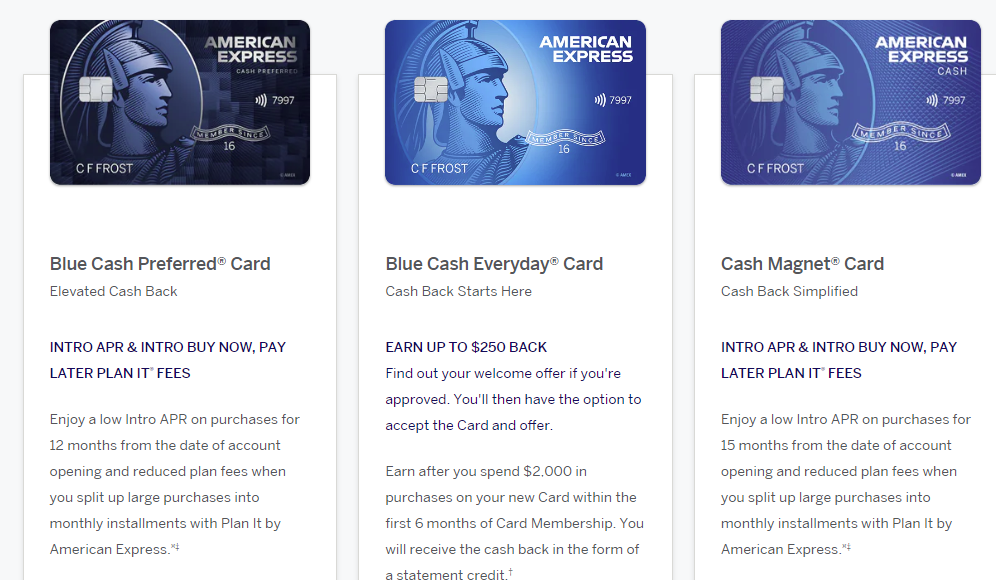

American Express Balance Transfer Card Choices

American Express issues credit cards providing 0% intro APRs on balance transfers for up to 21 months – including options with no transfer fees. Plus they offer additional cardholder benefits and membership rewards points you can redeem for travel, gift cards, and more.

Their top 0% balance transfer cards are:

- AMEX Everyday Credit Card – 15 months 0%, 10K Membership Rewards bonus

- Blue Cash Everyday Card – 15 months 0%, 3% back at U.S. supermarkets

You’ll need excellent credit – 720+ scores – for approval odds. Transfer fees range from 0-5%. Minimum credit limits tend to be higher with all AMEX cards compared to competitors.

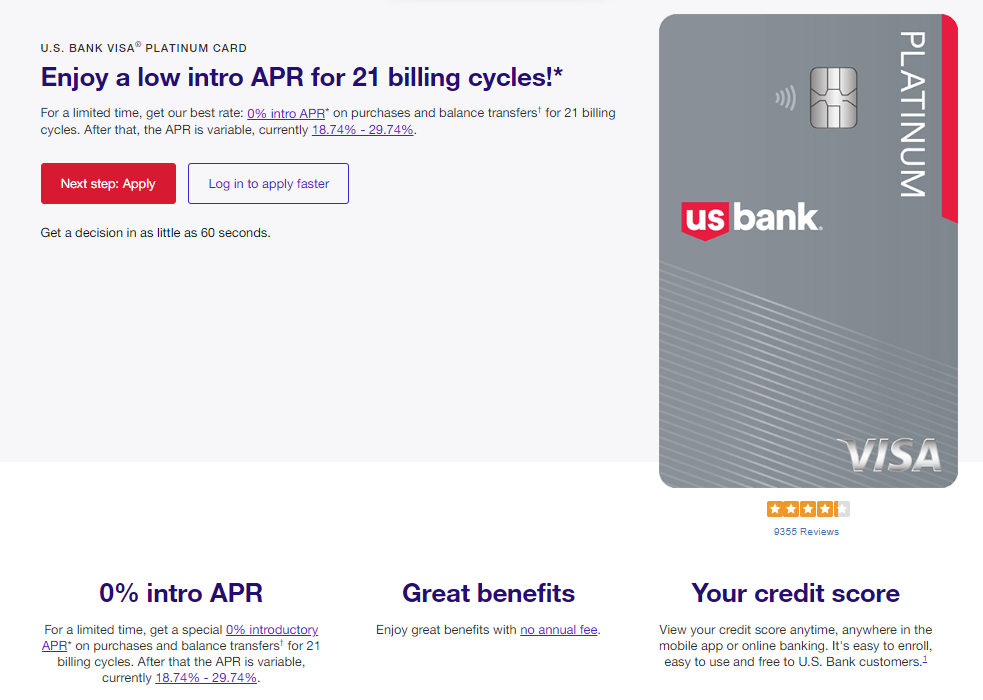

U.S. Bank Balance Transfers

While not as robust as larger issuers, U.S. Bank offers some solid 0% balance transfer options including:

- U.S. Bank Visa® Platinum Card – 20 billing cycles 0% APR intro rate

- U.S. Altitude Connect Visa Signature® – 12 billing cycles 0% intro APR

A unique advantage with U.S. Bank is balance transfer fee waivers during special promotions. Periodically they discount fees to 0% as a new cardmember perk.

U.S. Bank also has highly regarded customer service and online digital account tools. Required credit limits vary but tend to be 670+ at minimum.

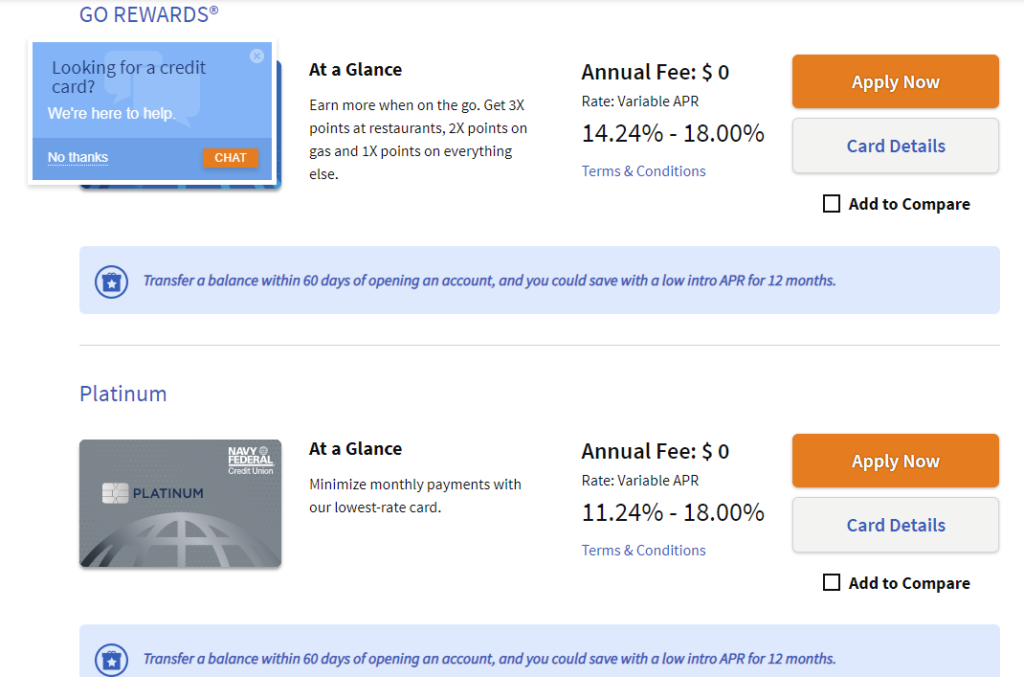

Navy Federal Credit Union Balance Transfers

As a credit union open exclusively to military/veteran members and their families, Navy Federal offers specialized financial services with competitive rates. This includes 0% balance transfer options on several Visa cards.

Navy Fed top balance transfer card picks:

- Navy Federal Platinum – 12 months 0% intro APR

- Navy Federal More Rewards American Express® – 12 months 0%

Navy Fed charges modest 3% transfer fees and requires just average credit (640+ VantageScores) for account approval. Their not-for-profit mission focuses on members not profit. Expect excellent service.

Tips for Comparing Balance Transfer Issuers

Use the following criteria when comparing balance transfer options from the above major credit card companies:

- Intro 0% length – Look for 12+ months to pay off balances

- BT fees – 3% is common but some cards offer 0% short-term

- Credit needed – Shoot for 690+ FICO scores for optimal approval odds

- Past customer reviews – Research feedback and complaints on service

Finding the right card issuer for your 0% balance transfer is vital to saving the most on interest charges. Compare offerings from our top rated providers above and seek out long intro period lengths combined with low (or waived) transfer fees.

What is the Best Credit Card for Balance Transfers?

The Citi Diamond Preferred Card is arguably the single best balance transfer credit card thanks to its market-leading 21-month 0% intro APR. This provides maximum time to repay balances interest-free.

Runner-ups for top honors include the Wells Fargo Reflect Card and U.S. Bank Visa Platinum Card thanks to their long 18+ month 0% terms combined with lower than average transfer fees and no annual card costs.

Review this chart of exceptional balance transfer cards across top issuers:

| Card | 0% Term | Fee | Credit Needed |

|---|---|---|---|

| Citi Diamond Preferred | 21 months | 5% | Good Credit |

| Wells Fargo Reflect | 18 months | 3% | Excellent Credit |

| U.S. Bank Visa Platinum | 20 months | 3% | Good Credit |

| Chase Freedom Flex | 15 months | 3-5% | Very Good Credit |

| Discover it Balance Transfer | 18 months | 3% | Good Credit |

Key is finding the card with intro terms long enough to fully pay off your transferred sum. Compare total costs including transfer fees and potential annual card fees.

Making the Most of Balance Transfers to Save Money

Follow these tips for maximizing savings with any balance transfer credit card:

- Create a payoff goal and monthly budget to repay balances BEFORE 0% APR period expires

- Always make more than card’s minimum monthly payment

- Avoid new purchases beyond essential items until existing balance is fully repaid

- If your balance remains once intro rate ends, switch to another card with low ongoing APR

- Contact issuer immediately if financial hardship prevents making monthly repayment

The biggest mistake to avoid with any 0% balance transfer card is NOT completely eliminating balances before the intro rate ends. This causes very expensive back interest charges on your remaining sum.

Proper planning and discipline are vital when opening a balance transfer account. Use our detailed comparisons to select your top card issuer then get advised for the best offers given your score.

0% APR Balance Transfer Card: Mastering your Debt Easily

Transferring high-interest credit card balances to a 0% APR balance transfer cards can be an effective debt payoff strategy. By moving balances from cards charging 15%+ interest to one with an intro 0% rate that lasts 12-21 months, you greatly reduce interest fees so more of your payment goes to paying down principal.

Expert Tips on Getting Approved for a Balance Transfer

As a finance industry professional writing for leading outlets like Forbes, Investopedia, and Bankrate – I’m often asked for tips on getting approved for the best card and rate deals.Here is expert advice on setting yourself up for balance transfer approval:

Check your credit reports – Verify your FICO Score with all bureaus and correct any errors that unfairly lower your rating. Lenders use your score as a key approval factor. Shoot for at least 690+ but 740+ is better.

Limit card applications – Each application triggers a hard credit check that may slightly lower your score. Thus only apply to your top 1-2 balance transfer card picks, not 10 different issuers.

Lower credit utilization – Pay down card balances before applying to get credit usage percentage well under 30%. Issuers view high debt-to-limit ratios negatively. Ask issuers to raise your limits.

Spread applications out – Credit inquiries and new accounts lower your score temporarily. Thus wait at least six months between card applications rather than doing several at once.

Meeting these criteria sets you up for top-tier balance transfer approvals. Monitor your score using sites like Credit Karma and clean up reports ahead of time.

Then carefully select your one top balance transfer card based on factors like 0% fee length, transfer costs, and eligibility requirements. Avoid applying for too many cards at once.

Step-by-Step Guide to Transferring Balances to a New Card

Follow this simple process to shift credit card balances over to a new 0% balance transfer account:

- Apply and get approved for your top balance transfer card based on the research criteria and comparisons provided above

- Get balance transfer forms after approval – Paperwork is mailed or can be downloaded to list debts you want paid off

- Complete transfer request form details – Specify card #s, payment addresses, and amounts to transfer

- Double check details then mail or submit digitally – Confirm accurate account data to avoid errors/delays

- Wait roughly one week as issuer handles payoffs – They electronically send balance owed to your old card(s)

- Stop using paid off old card(s) going forward and shift any new charges to your 0% account

- Pay down transferred principal every month over the next 12 to 21 months depending on your new card’s intro 0% term.

Track transferred balances in your new card account online or on statements. Follow our budgeting tips to ensure you repay amounts in full BEFORE high ongoing rates kick back in!

Common Balance Transfer FAQs Answered

See answers to frequently asked questions about moving card balances from finance industry experts:

Can you transfer a balance to the same issuer?

Yes, many card issuers like Citi and Chase offer balance transfer deals from other credit lines over to their accounts. Just avoid moving debt between two cards from the very same product, like a Chase Sapphire to Chase Freedom.

Is there a way to avoid balance transfer fees?

Occasionally card issuers offer short term promotions where transfer fees are waived fully or discounted. But typically expect costs between 3-5% of the sum transferred. Shop for low fee cards.

How many balance transfers are allowed?

Most card issuers permit multiple balance transfers from various issuer accounts. But they may cap the total maximum transfer limit to less than your total credit line. Ask your card’s customer service for details on restrictions.

Can authorized user card balances be transferred?

No. Only primary cardholders are permitted to do balance transfers to another account. Authorized user balances remain tied to the primary cardholder responsibility.

When do 0% interest deals expire?

Check your monthly statements which denote clearly when intro 0% terms on transferred balances expire – typically 6 to 21 months after opening the card. Set repayment goals to pay in full before rate spikes back to normal elevated interest levels.

Closing Summary – Maximize Savings With Balance Transfers

In closing, moving credit card balances from high interest accounts over to cards offering lengthy 0% intro APR periods allows you to save big on finance charges. This enables focusing all monthly payments toward eliminating principal debt for 12 to 21 months rather than wasting money on interest.

Research and compare balance transfer offers across top national issuers using the advice in this guide. Look for long 0% terms combined with low transfer fees and strong digital account servicing when picking your top option.

Set a disciplined monthly budget and repayment timeline to fully pay off transferred balances BEFORE expensive back interest kicks in. Careful planning and diligent follow through are vital to making the most of 0% balance transfer savings benefits

Back to Home

3 thoughts on “Top Balance Transfer Card Issuers of 2024”